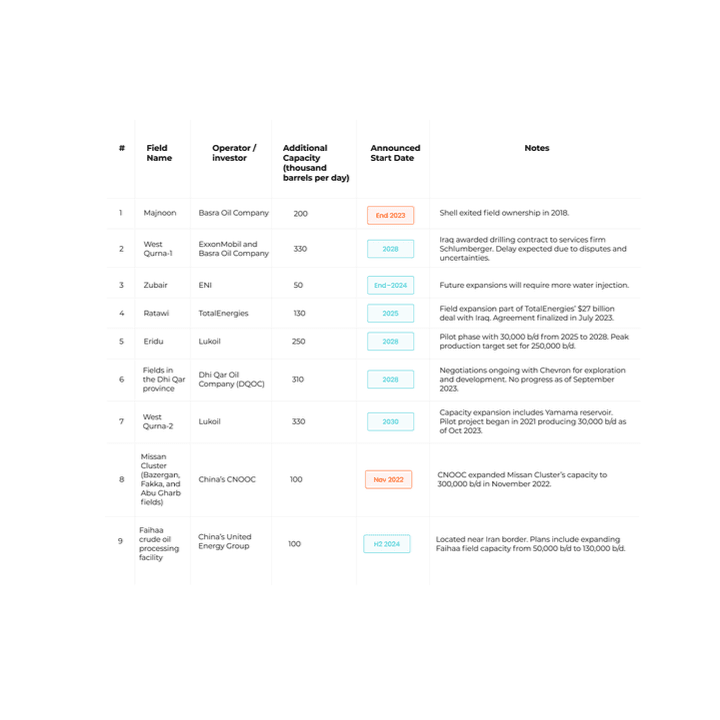

Iraq continues to solidify its position as a major force in the global energy market with several significant crude oil projects. Below is a detailed look at the key projects and developments scheduled for the coming years.

The planned expansions and developments in Iraq's oil fields underscore the country's critical role in the global energy market. These projects not only aim to increase production capacity but also address technological and logistical challenges, such as water injection requirements and the integration of advanced drilling techniques.

While these projects present significant opportunities, they also come with challenges, including political instability, regulatory delays, and the need for substantial infrastructure investments. The ongoing negotiations and potential delays highlight the complex landscape in which Iraq operates.

Iraq's ambitious plans to expand its crude oil production capacity reflect its commitment to maintaining and enhancing its position in the global energy market. By overcoming existing challenges and successfully executing these projects, Iraq can ensure sustained economic growth and stability, reinforcing its pivotal role in the global energy sector.

Iraq stands as a pivotal player in the global energy market, underpinned by its vast oil reserves and significant production capabilities. With confirmed oil reserves ranking fifth globally at 145 billion barrels, Iraq's influence on global energy dynamics is substantial.

Iraq is a key member of the Organization of the Petroleum Exporting Countries (OPEC), ranking second in crude oil production within the organization, only behind Saudi Arabia. On a global scale, Iraq stands sixth in the total production of petroleum liquids. The country's major oil fields are primarily located in regions such as Basra, Diyala, and Kirkuk, which are critical hubs for its oil extraction and export activities.

The Iraqi economy is heavily reliant on oil exports, which constitute about 95% of its revenue. In 2022, Iraq's oil export revenue soared to $131 billion, up from $92 billion in the previous year. This significant increase underscores the centrality of oil to Iraq's economic health and its role in the global energy market.

Despite forming a consensus government after the parliamentary elections in 2021, Iraq faces challenges in the timely enactment of legislation and budget approvals. These delays can hinder major energy projects and impact the country's ability to fully leverage its oil resources for economic growth and stability.

To maximize its energy potential, Iraq must address ongoing challenges in budget approvals and infrastructure development. Enhancing infrastructure is crucial for boosting production capacity and ensuring efficient export operations. Investments in infrastructure will also help Iraq better handle the technical and logistical demands of its vast oil industry.

Iraq's substantial oil reserves, estimated at over 140 billion barrels, position it as a key global energy player. Its ability to influence global oil prices and supply dynamics is significant, given its production capacity and export volume. As the world's energy landscape continues to evolve, Iraq's role remains crucial in maintaining the balance and stability of global oil markets.

In conclusion, Iraq's vast oil reserves and its significant role in OPEC highlight its importance in the global energy market. However, to fully harness its potential, Iraq must address legislative delays and infrastructure challenges. By overcoming these obstacles, Iraq can ensure sustained economic growth and continue to be a major force in the global energy sector.

Gulf countries are pressuring the U.S. and Israel to avoid attacks on Iranian oil facilities, fearing retaliation against their own oil infrastructure. Iran has warned Saudi Arabia that it cannot ensure the safety of Saudi oil sites if Israel strikes Iran, and Saudi Arabia has refused to let Israel use its airspace for such attacks.

Source: Reuters

At Connectly.24, we are thrilled to share some exciting updates that mark a significant milestone in our journey. As we continue to grow and evolve, we are expanding our footprint and service offerings to better serve our clients across the region.

To enhance our accessibility and support, we are proud to announce the opening of new offices in key locations:

We are excited to offer an expanded range of services designed to meet the evolving needs of our clients:

In addition to these new services, we continue to offer our expertise in tendering, contracting, and public relations within the oil and gas sector. Our commitment to excellence in these areas remains unwavering.

Connectly.24 is officially registered with IDC and the Central Government under Registration No. 000087552. This certification underscores our adherence to industry standards and our dedication to providing top-notch services.

We invite you to connect with us and explore how our expanded services and new locations can benefit your projects. Stay tuned for more updates as we continue to grow and innovate!

For more information or to get in touch with our new offices, please visit our website or contact us directly.

#Connectly24 #NewLocations #ExpandedServices #CivilEngineering #OilAndGas #Dubai #Basra #Erbil

_2026-01-13_12%3A33%3A13.jpeg&w=828&q=75)